Closing Costs: Everything Homebuyers Need To Know Before Settlement—Purchasing a home is a momentous milestone, but it also entails costs beyond the purchase price. Closing costs are fees levied at the conclusion of a real estate transaction, and they can add a significant sum to the total cost of homeownership. Understanding these costs is crucial for homebuyers to avoid surprises and ensure a smooth settlement process.

Editor's Notes: "Closing Costs: Everything Homebuyers Need To Know Before Settlement" has been published today, 2023-04-25, to help homebuyers understand the importance of closing costs and make informed decisions during the home buying process.

Through meticulous analysis and extensive research, we've compiled this comprehensive guide to empower homebuyers with the knowledge they need to navigate closing costs effectively.

Key Differences between Closing Costs and Down Payment:

| Closing Costs | Down Payment |

|---|---|

| Closing costs are fees paid at the conclusion of a real estate transaction. | A down payment is a percentage of the purchase price paid upfront by the buyer. |

| Closing costs can vary depending on factors such as the loan type, property location, and lender. | The down payment amount is typically fixed and determined by the buyer's financial situation and loan terms. |

| Closing costs are typically paid in addition to the down payment. | The down payment is deducted from the purchase price to determine the loan amount. |

Transition to main article topics: In the subsequent sections, we will delve into the types of closing costs, methods of payment, and strategies for negotiating and minimizing these expenses. By equipping homebuyers with this valuable information, we aim to empower them to make informed decisions and navigate the closing process with confidence.

FAQ: Closing Costs

Closing costs, also known as settlement costs, are expenses beyond the home's purchase price that the buyer incurs to finalize the mortgage. These costs can vary depending on the lender, loan type, and location of the property.

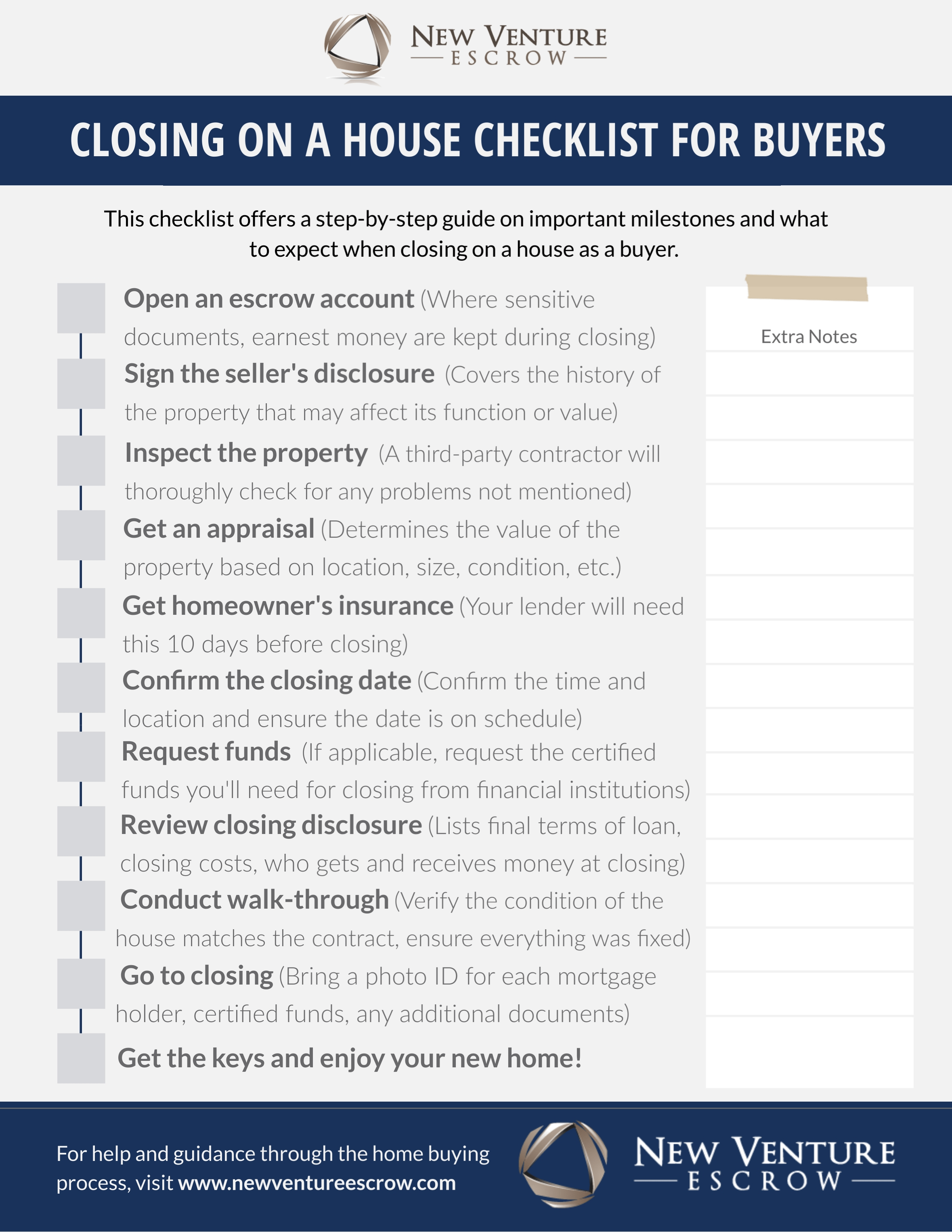

Buying For New House Checklist - Source ar.inspiredpencil.com

Question 1: What are closing costs?

Closing costs typically range from 2% to 5% of the loan amount and cover various fees associated with the mortgage transaction. These include loan origination fees, appraisal fees, title insurance, attorney fees, and recording fees.

Question 2: Who pays closing costs?

Traditionally, the buyer covers closing costs, but in some cases, the seller can contribute or offer concessions to help offset these expenses.

Question 3: Can I negotiate closing costs?

While closing costs are not always negotiable, some fees, such as lender fees and title insurance, may be subject to negotiation. It's advisable to compare quotes from multiple lenders and title companies to secure the most favorable terms.

Question 4: Can I roll closing costs into my mortgage?

Yes, in some cases, it's possible to finance closing costs into your mortgage, increasing your loan amount but potentially saving you money upfront.

Question 5: How can I reduce closing costs?

Negotiating fees, shopping around for lenders, obtaining lender credits, and exploring down payment assistance programs are effective ways to reduce closing costs.

Question 6: When are closing costs typically paid?

Closing costs are generally due at the closing, the final step in the homebuying process, where you sign the mortgage documents and officially take ownership of the property.

Understanding closing costs is crucial for budgeting and planning for your home purchase. By researching and negotiating fees, buyers can navigate the process more effectively and confidently.

Next: Title Insurance: A Comprehensive Guide for Homebuyers

Tips

Navigating closing costs is a crucial part of the homebuying journey. By understanding the details and considering these tips, you can make informed decisions and ensure a smooth settlement process.

Tip 1: Calculate accurately

Closing costs typically range from 2% to 5% of the home's purchase price. The exact amount varies depending on factors like location, loan type, and title company. To budget effectively, obtain a Loan Estimate that outlines the estimated closing costs and review it carefully.

Tip 2: Shop around for services

Don't settle for the first quotes you receive for closing services. Different title companies, lenders, and insurance providers may offer varying fees. Comparing quotes allows you to find the most competitive rates and potentially save money.

Tip 3: Negotiate closing credits

In some cases, sellers may be willing to contribute towards closing costs. This is known as a seller concession. Negotiate with the seller during the homebuying process to determine if they are open to offering closing credits.

Tip 4: Explore down payment assistance programs

If closing costs are a significant financial hurdle, explore down payment assistance programs offered by government agencies, non-profit organizations, and some lenders. These programs provide financial assistance to help first-time homebuyers and low-income families cover closing costs.

Tip 5: Factor in additional expenses

Beyond the closing costs outlined in the Loan Estimate, there may be additional expenses to consider, such as moving costs, homeowners insurance premiums, and property taxes. It's wise to budget for these expenses to ensure a smooth transition into homeownership.

Tip 6: Seek professional advice

If you are unfamiliar with the closing process or have any concerns, don't hesitate to seek professional advice from a real estate attorney, lender, or financial advisor. They can provide valuable guidance and help protect your interests.

By following these tips, you can gain a comprehensive understanding of closing costs and make informed decisions. Remember to budget accurately, explore options to reduce costs, and seek professional advice when needed. For more in-depth insights, refer to Closing Costs: Everything Homebuyers Need To Know Before Settlement.

Closing Costs: Everything Homebuyers Need To Know Before Settlement

Closing costs are expenses incurred during the finalization of a real estate transaction. They typically range from 2% to 5% of the purchase price and can include various fees and charges. Understanding these costs is crucial for homebuyers to ensure a smooth settlement process.

- Loan Origination Fee: Charged by the lender to cover loan processing and underwriting costs.

- Title Insurance: Protects the lender and buyer from potential title defects or liens.

- Property Taxes: Prorated and collected at closing, covering the period from the date of purchase to the end of the current tax year.

- Homeowners Insurance: Required by lenders to protect the property against damage or loss.

- Recording Fee: Paid to the county or municipality to record the deed and mortgage documents.

- Attorney Fees: May be incurred for legal representation during the closing process.

These key aspects represent essential components of closing costs. Loan origination fees cover the lender's administrative expenses, while title insurance safeguards against potential title issues. Property taxes ensure the payment of property-related taxes, and homeowners insurance protects the home and its contents. Recording fees formalize the property transfer, and attorney fees provide legal assistance during closing. Understanding these aspects helps homebuyers make informed decisions, avoid surprises, and prepare adequately for the settlement.

Are you a first-time homebuyer needing a little help with your down - Source www.pinterest.com

Closing Costs: Everything Homebuyers Need To Know Before Settlement

Closing costs are fees paid by homebuyers to cover the expenses associated with obtaining a mortgage and transferring property ownership. These costs can vary widely depending on the location of the property, the type of loan being obtained, and the services provided by the lender and settlement agent. It is important for homebuyers to be aware of all of the potential closing costs involved in their purchase so that they can budget accordingly.

Mortgage Guide for Homebuyers in Washington D.C. Area: Everything You - Source www.onestreet.one

Some of the most common closing costs include:

- Loan origination fee

- Underwriting fee

- Appraisal fee

- Title search fee

- Title insurance premium

- Settlement fee

- Recording fee

- Transfer tax

- Property taxes

- Homeowners insurance premium

The total cost of closing costs can range from 2% to 5% of the purchase price of the home. In some cases, the seller may be willing to pay some or all of the closing costs. However, it is important to remember that closing costs are always the responsibility of the buyer, regardless of who pays them.

Homebuyers should carefully review all of the closing costs associated with their purchase before signing any documents. They should also shop around for the best rates on these costs. By understanding all of the costs involved, homebuyers can avoid any surprises at the closing table.

Closing costs are an important part of the home buying process. By being aware of all of the potential costs involved, homebuyers can budget accordingly and avoid any unexpected expenses.