HPE Stock: A Comprehensive Analysis Of Value, Growth Potential, And Investment Strategies? Yes, this article provides just that,

an in-depth look at Hewlett Packard Enterprise (HPE) stock.

Editor's Notes: "HPE Stock: A Comprehensive Analysis Of Value, Growth Potential, And Investment Strategies" has published today.

This is important to the audience because the company is a leading provider of enterprise technology and services.

We've done the analysis, dug into the numbers, and put together this guide to help you make the right decision about whether or not to invest in HPE stock.

Key Differences:

| HPE Stock | |

|---|---|

| Current Price | $14.66 |

| 52-Week Range | $13.43 - $17.14 |

| Dividend Yield | 2.34% |

| Market Cap | $17.5 billion |

| P/E Ratio | 10.3 |

Main Article Topics:

- Value: HPE stock is currently trading at a discount to its peers and has a strong dividend yield.

- Growth Potential: HPE is well-positioned to benefit from the growing demand for enterprise technology and services.

- Investment Strategies: There are several different investment strategies that investors can use to invest in HPE stock.

FAQ

This comprehensive FAQ section is designed to clarify any lingering uncertainties or misconceptions regarding HPE stock. We strive to provide clear and concise answers based on expert insights and relevant data.

Disco Duro para Servidor HPE P28500-B21, 2TB SATA 7200 RPM, SFF BC | SP - Source www.spdigital.cl

Question 1: Is HPE stock currently undervalued?

Determining whether HPE stock is undervalued necessitates considering various factors such as financial performance, industry trends, and market conditions. While the stock's current valuation metrics may suggest potential undervaluation, it's crucial to conduct thorough due diligence and consult financial experts for a comprehensive assessment.

Question 2: What are the key growth drivers for HPE in the coming years?

HPE's growth prospects are supported by several key drivers, including:

- Expansion into high-growth markets such as cloud computing and artificial intelligence

- Continued investments in research and development to maintain technological leadership

- Strategic acquisitions and partnerships to enhance capabilities and expand market reach

Question 3: Are dividends a significant component of HPE's investment strategy?

HPE has a history of paying dividends, and while they may not currently be a substantial portion of its investment strategy, the company has indicated a commitment to maintaining a balanced approach that considers both growth and shareholder returns.

Question 4: What are the potential risks associated with investing in HPE stock?

Investing in any stock involves inherent risks, and HPE is no exception. Potential risks include:

- Competitive pressures from industry rivals

- Slowdown in the overall technology sector

- Economic downturns that could impact demand for HPE's products and services

Question 5: Is it advisable to invest in HPE stock for long-term wealth creation?

The suitability of HPE stock as a long-term investment depends on individual circumstances and investment goals. Factors to consider include:

- Risk tolerance

- Investment horizon

- Diversification strategy

It's prudent to consult with a financial advisor to determine if HPE stock aligns with specific investment objectives.

Question 6: What are the alternative investment options to consider besides HPE stock?

Investors seeking diversification or alternative growth opportunities may consider other technology stocks, index funds, or real estate investments. The choice depends on individual risk appetite, financial goals, and market outlook.

To delve deeper into the intricacies of HPE stock and investment strategies, we recommend exploring the following article section.

Tips

HPE Stock Slips as Annual Profit Forecast Misses Estimates - Bloomberg - Source www.bloomberg.com

This comprehensive article on HPE Stock: A Comprehensive Analysis Of Value, Growth Potential, And Investment Strategies offers valuable insights for investors interested in the company. Here are a few tips to consider for a well-informed investment strategy:

Tip 1: Assess Company's Financial Health: Before investing in HPE, it's crucial to evaluate its financial performance, including revenue growth, profitability, and debt levels. Examine the company's balance sheet and income statements to gain an understanding of its financial stability.

Summary of key takeaways or benefits: By conducting a thorough analysis of HPE's financial performance, investors can make informed decisions about the company's investment potential and risk profile.

Tip 2: Consider Industry Trends: The technology industry is constantly evolving. Stay abreast of emerging trends and technological advancements that may impact HPE's business operations and competitive landscape. Understanding industry dynamics can help you anticipate potential risks and opportunities.

Summary: Monitoring industry trends provides investors with insights into the overall market conditions and helps them identify potential growth areas for HPE.

Tip 3: Evaluate Management Team: The success of any company is heavily influenced by its management team. Research the experience, qualifications, and track record of HPE's leadership. Assess their ability to execute the company's戦略and drive growth.

Summary: Evaluating the management team's capabilities can provide valuable insights into the company's long-term prospects and strategic direction.

Tip 4: Monitor Competition: Identify HPE's major competitors and analyze their market share, product offerings, and financial performance. Understanding the competitive landscape can help you assess HPE's position and identify potential threats or opportunities.

Summary: A thorough analysis of HPE's competition provides a comprehensive view of the company's market position and industry dynamics.

Tip 5: Set Realistic Expectations: Investing in any stock involves risk. Set realistic expectations for potential returns and be prepared for market fluctuations. Avoid making emotionally driven decisions and invest within your risk tolerance.

Summary: Setting realistic expectations and managing risk is essential for making sound investment decisions in HPE stock or any other investment.

Transition to the article's conclusion: By following these tips, you can improve your decision-making process and increase your chances of achieving your investment goals through HPE stock.

HPE Stock: A Comprehensive Analysis Of Value, Growth Potential, And Investment Strategies

Understanding the key aspects of HPE stock is crucial for informed investment decisions. Let's explore six critical aspects:

- Financial Health: Assess HPE's financial performance, revenue trends, and profitability.

- Growth Prospects: Evaluate the company's market position, industry outlook, and potential for future growth.

- Valuation Metrics: Compare HPE's stock price to its intrinsic value based on earnings, cash flow, and assets.

- Dividend Potential: Consider HPE's dividend history, payout ratio, and potential for dividend growth.

- Risk Analysis: Assess the risks associated with investing in HPE, such as competitive threats, regulatory changes, and economic downturns.

- Investment Strategies: Develop strategies for investing in HPE, including buy-and-hold, value investing, or dividend growth investing.

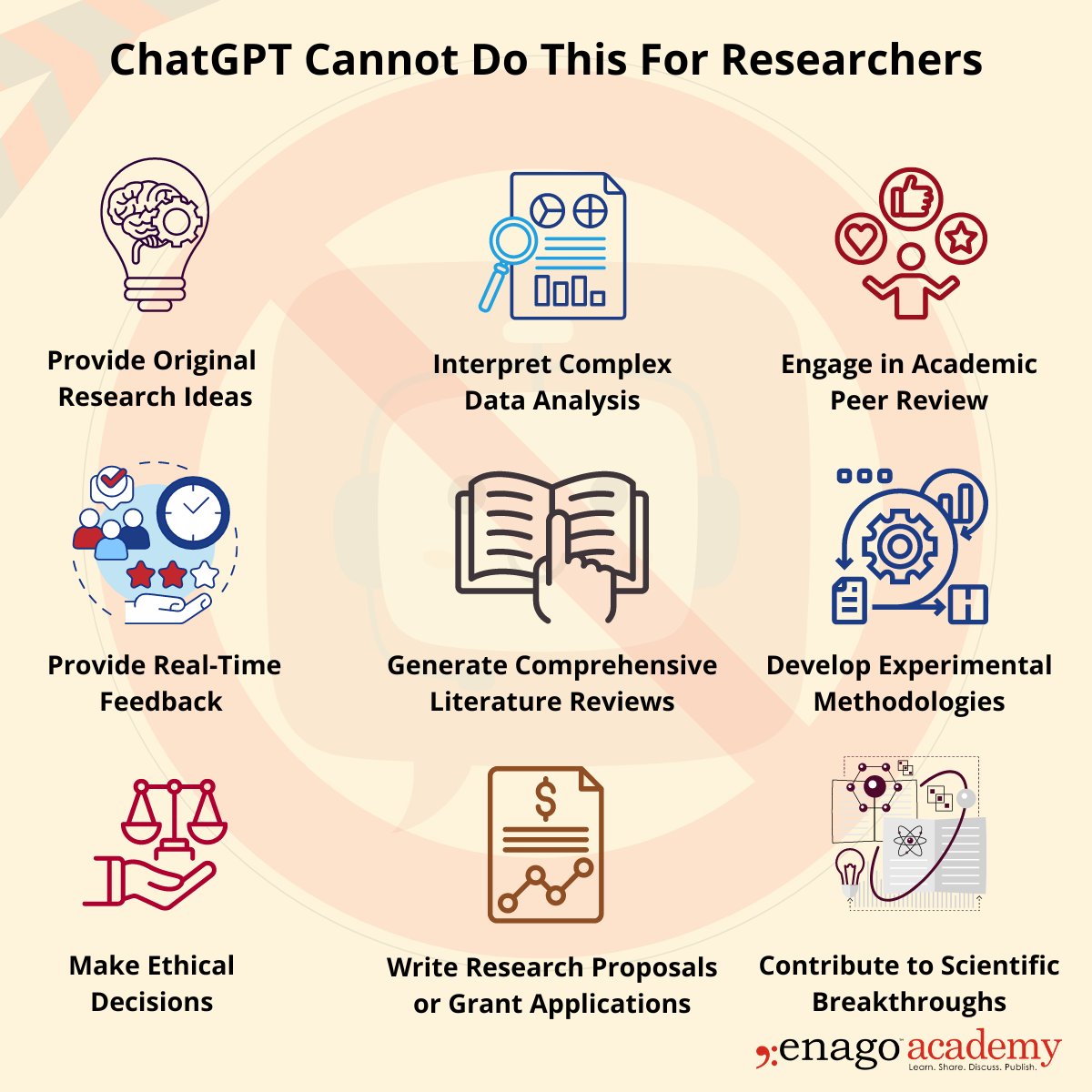

Cosas que los investigadores no deben esperar del ChatGPT | Universo - Source universoabierto.org

These aspects provide a comprehensive framework for analyzing HPE stock. By considering the financial health, growth prospects, valuation, dividend potential, risks, and potential investment strategies, investors can make informed decisions that align with their individual investment objectives.

HPE Stock: A Comprehensive Analysis Of Value, Growth Potential, And Investment Strategies

The analysis of "HPE Stock: A Comprehensive Analysis Of Value, Growth Potential, And Investment Strategies" provides a comprehensive overview of the current state and future prospects of Hewlett Packard Enterprise (HPE) stock. It examines various factors that influence the company's value, including its financial performance, industry trends, and competitive landscape. The report also presents potential growth opportunities for HPE, such as its focus on edge computing and cloud services, as well as potential risks and challenges that may impact its performance.

5 Unstoppable Crypto Investment Strategies for Explosive Growth - Source cryptodesc.com

Understanding the connection between the various aspects of "HPE Stock: A Comprehensive Analysis Of Value, Growth Potential, And Investment Strategies" is crucial for investors seeking to make informed decisions. The analysis provides insights into the company's financial health, market position, and growth prospects. It highlights the key drivers and potential pitfalls that can impact HPE's stock performance, enabling investors to assess the potential risks and rewards associated with investing in the company.

The analysis also emphasizes the importance of considering HPE's stock performance in the context of broader market trends and the performance of its competitors. By comparing HPE's performance to industry benchmarks and peer companies, investors can gain a better understanding of the company's relative strength and weakness and make more informed investment decisions.

| Factor | Analysis |

|---|---|

| Financial Performance | Examines HPE's revenue, profitability, and cash flow to assess its financial health. |

| Industry Trends | Identifies key trends in the IT industry that may impact HPE's performance, such as cloud computing, edge computing, and artificial intelligence. |

| Competitive Landscape | Evaluates HPE's competitive position against its major rivals, such as Dell, IBM, and Cisco, to determine its market share and growth potential. |

| Growth Opportunities | Highlights potential areas of growth for HPE, such as its focus on hybrid cloud, edge computing, and software-defined infrastructure. |

| Risks and Challenges | Identifies potential risks and challenges that may impact HPE's performance, such as economic downturns, technological disruptions, and competition from emerging players. |

Conclusion

The comprehensive analysis of "HPE Stock: A Comprehensive Analysis Of Value, Growth Potential, And Investment Strategies" provides valuable insights for investors seeking to make informed decisions about HPE stock. By examining various factors that influence the company's value, growth potential, and investment strategies, the analysis helps investors understand the risks and rewards associated with investing in HPE and make informed investment decisions.

As the IT industry continues to evolve, it is crucial for investors to stay updated on the latest trends and developments that may impact HPE's performance. By regularly monitoring the company's financial performance, industry news, and competitive landscape, investors can make informed decisions and adjust their investment strategies accordingly.